Corporate Bankruptcies Balloon in Early 2023

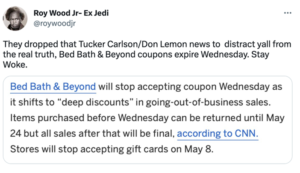

As speculation swirled this week about the drama in cable news circles, actor and comedian Roy Wood Jr. offered a tongue-in-cheek explanation about the supposedly coincidental timing of announcements that hosts Tucker Carlson and Don Lemon lost their jobs with Fox News and CNN, respectively. It had nothing to do with behind-the-scenes network gossip.

Unfortunately for compulsive coupon clippers, the news about home goods retailer Bed Bath & Beyond going out of business is no joke: It plans to shutter all 360 of its stores along with its 120 Buy Buy Baby locations by June 30. Bed Bath & Beyond is just one of a surging number of corporate bankruptcies in 2023.

The total number of corporate bankruptcy filings in January and February reached a 12-year high, according to data from S&P Global Market Intelligence. Coming off what S&P described as “a historically slow year in 2022,” the first two months of 2023 saw 111 corporations file bankruptcy petitions. The news didn’t get any better in March, when the number of bankruptcies for that month reached the highest point since near the start of the Covid-19 pandemic in July 2020.

The demise of Bed Bath & Beyond fit with an increasingly dim outlook for what S&P calls the “consumer discretionary” sector, which includes retail companies. On top of the growth of ecommerce and home-based entertainment options, the pandemic struck the sector particularly hard. Seventeen companies in the category filed for bankruptcy in January and February, more than any other sector. The industrial sector had the second-most bankruptcies during the period with 10.

The news of turmoil at movie theater operator Cineworld also fit the trend among consumer discretionary businesses. The UK-based theater chain began Chapter 11 proceedings in Texas in September and announced in January that it would close 39 Regal Cinemas theaters across the United States. Cineworld recently filed a plan intended to enable it to emerge from bankruptcy protection in the coming months.

However, the bankruptcy story generating the most interest in the business and legal worlds now may be Johnson & Johnson’s attempt to pull off a “Texas Two-Step.” If successful, J&J could substantially reduce its exposure to damages from a flood of lawsuits claiming its baby powder and talc products cause cancer.

Essentially, the Texas Two-Step refers to a legal maneuver in which a parent company transfers its tort liabilities to a spin-off entity that remains under the parent company’s control. This is the “Texas” part of the strategy, as the transaction is known as a Texas divisive merger. The new entity then files for bankruptcy, shielding the assets of the parent company from litigants’ claims.

Not surprisingly, the Texas Two-Step is a highly controversial legal strategy, and it’s a dance that few companies have the chutzpah to do. Early signs indicate it won’t work for J&J either, which might be the death knell for the Texas Two-Step going forward. In the minds of legal scholars such as University of Illinois College of Law professor Ralph Brubaker, an authority on the strategy, that is probably a good thing.

“This is a rather audacious ploy,” said Brubaker in an interview with Bloomberg. “Such cynical strategic machinations to manufacture self-inflicted financial distress hardly bolster the case for a legitimate, good faith resort to bankruptcy relief.”